March 9, 2022 | After a year-long application, vetting and onboarding process, the Sacramento Valley Small Business Development Center (SBDC) is open for business, and California Capital Financial Development Corporation (FDC) is thrilled about the opportunity to host the program.

In January of 2021, the NorCal Small Business Development Center program sent out an open request for proposals to host SBDC service centers within its 36-county territory for the purposes of delivering no-cost one-on-one advising and free or low-cost trainings to small businesses.

The SBDC is the largest technical assistance provider for small businesses in the U.S. and is part of a national network of nearly 1,000 centers, which are funded by grants through the U.S Small Business Administration (SBA). In California, these are supplemented by the State of California’s Governor’s Office of Business and Economic Development (GO-Biz).

Previously called the Capital Region SBDC, the renamed Sacramento Valley SBDC is one of 16 service centers in Northern California where small businesses can get the help they need to start and grow their enterprise.

“Coming out of the COVID business crisis, the SBDC recognizes the need for innovative approaches to entrepreneurship,” said NorCal SBDC Associate Region Director Ann Johnson-Stromberg. “Every partner has something different to offer and we are excited about this one with California Capital.”

The SBDC is the largest technical assistance provider for small businesses in the U.S. and is part of a national network of nearly 1,000 centers, which are funded by grants through the U.S Small Business Administration (SBA). In California, these are supplemented by the State of California’s Governor’s Office of Business and Economic Development (GO-Biz).

In 2020, the NorCal SBDC provided workshops to 39,575 attendees, and no-cost, one-on-one advising to more than 26,000 small businesses through its combined 20 service centers and regional programs in the northern half of the state. The positive economic results included assisting clients access an unprecedented $539 million in loans and investment capital last year. The program also helped clients start 316 new businesses, created 8,500 new jobs and helped increase sales by nearly $266 million.

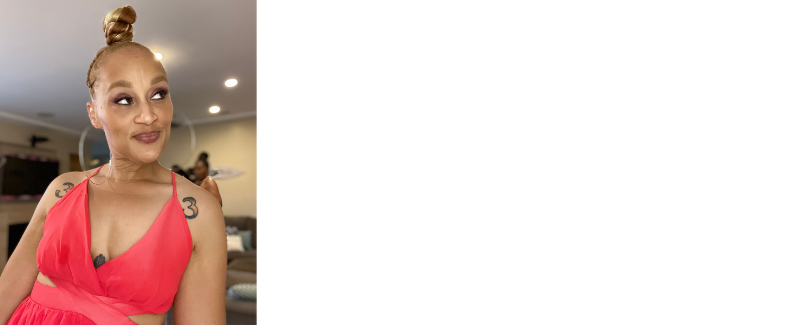

SiewYee Lee-Alix, an experienced business advisor and former program development manager with California Capital FDC, was hired in January to lead the newly launched center in Sacramento that will provide services to small businesses in Sacramento, Sutter, Yolo, and Yuba Counties.

“SiewYee’s deep knowledge of the business development landscape complements her passion for connecting small business owners to the resources they need, and seeing them thrive,” said California Capital FDC president and CEO, Deborah Lowe Muramoto. “As an integral part of the California Capital FDC team, she used her expertise in procurement and program development to help small businesses remain open and even expand during the COVID-19 pandemic.”

SBDC Day is Wednesday, March 16, 2022. SBDC Day is a national, collective proclamation of the impact America’s Small Business Development Centers (SBDCs) have on the success of our nation’s dreamers, innovator, and doers: America’s small businesses.

For more information on Sacramento Valley SBDC or to apply for SBDC Services, visit www.sacramentovalleysbdc.org or call (916) 655-2100.

# # #

About the California SBDC Program

The California Small Business Development Center (SBDC) Program is the leader in providing small business owners and entrepreneurs with the tools and guidance needed to become successful. Local SBDCs provide comprehensive and expert guidance on issues such as start-up basics, financing, business and marketing plan development, exporting, technology advising, procurement and government contracting. One-on-one advising is funded by the U.S. Small Business Administration and local partners and is offered at no cost. Consulting is supplemented by low-cost or free seminars and conferences. These services are delivered throughout California via an extensive network of 49 Small Business Development Centers. The California SBDC network serves more than 65,000 small business owners annually. Learn more by visiting: www.californiasbdc.org

About SBA

The U.S. Small Business Administration (SBA) was created in 1953 as an independent agency of the federal government to aid, counsel, assist and protect the interests of small business concerns, to preserve free competitive enterprise and to maintain and strengthen the overall economy of our nation. Small business is critical to economic recovery and strength, to building America’s future, and to helping the United States compete in today’s global marketplace. Although SBA has grown and evolved in the years since it was established in 1953, the bottom line mission remains the same. The SBA helps Americans start, build and grow businesses. Through an extensive network of field offices and partnerships with public and private organizations, SBA delivers its services to people throughout the United States, Puerto Rico, the U. S. Virgin Islands and Guam. www.sba.gov

business that could give back to the community, something that I would love to keep and pass down to my kids as a family-owned business.”

business that could give back to the community, something that I would love to keep and pass down to my kids as a family-owned business.”